Search for topics or resources

Enter your search below and hit enter or click the search icon.

Flood insurance coverage is something that all insurance agents and homeowners should know very well. Keep it close to the chest when it comes to fully understanding the extent of what you're writing on your policy.

In today's episode, we want to tackle flood insurance coverages; specifically how replacement costs can be different from the actual cash value (ACV) and the dangers of choosing one thing from another.

When it comes to writing your flood insurance policy, you should be able to know which is the best option between replacement costs and ACV. Most insurance carriers provide homeowners with the ability to either opt into replacement costs or ACV.

But what is the difference between the two?

Replacement cost — from the phrase itself which is very self-explanatory — is the amount given to the insured in order to fully restore and/or rebuild the property after being damaged.

Let's give an example, if you choose to get replacement cost for your flood insurance for a home that's worth $240,000, then you will be able to get this exact amount from your insurance provider. In the NFIP, coverages actually max out at $250,000 building coverage and there are no amount limits in the private flood insurance market.

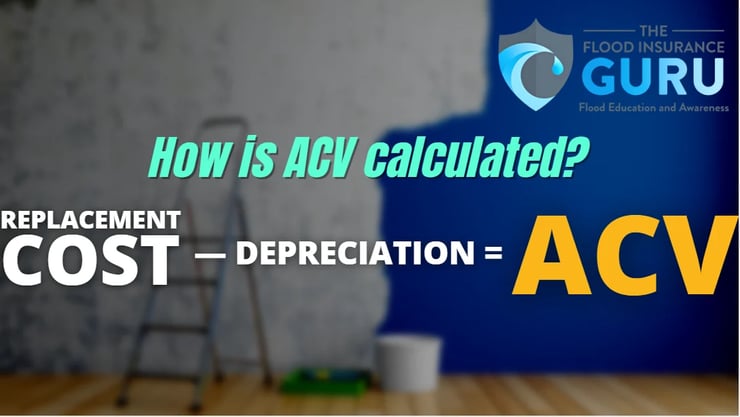

On the other hand, actual cash value (ACV) is a different story. This time around we won't be talking about the exact amount needed to fully restore your insured building, but its exact value in actual money.

This is calculated by using the replacement cost value of the property subtracted by depreciation. This means that the overall depreciation of the value of your insured building will be the sole basis of how much you'll be getting.

This means that one way or the other, you won't be getting $240,000 on your insurance if you choose ACV. This is why choosing Actual Cash Value is dangerous for homeowners because you're getting less than what you really need.

There are two ways to make sure that you won't get blindsided when your flood insurance claim pays out.

The first way to make sure that you don't get ACV in your insurance is by checking the policy. You want to make sure that you get to read your flood insurance policy very well before you proceed on purchasing it, and also make sure that you have replacement costs as your coverage option.

You can ask your insurance agent to help you with this and it's pretty easy for them to determine this. A great insurance agent will make sure that the policy you have is under replacement cost coverage.

Another thing you want to make sure of is that you're following the 80% rule. Both FEMA and private flood insurance have this type of rule. The rule states that you must ensure your property for at least 80% of its cost.

By following the 80% rule, you can have the assurance that you won't be getting a significantly lower amount of coverage when your policy starts to payout.

If you want to learn more about flood insurance coverages, how to manage your flood policy, or anything related to flood insurance, you can click below to access our Flood Learning Center where we answer your flood and insurance questions.

You can also click on this picture below to contact us and discuss your flood insurance concerns.

Remember, we have an educational background in flood mitigation which lets us help you understand your flood insurance, how it can be managed, flood risks, and mitigating your property to preserve its value long-term.