Property owners need to replacement coverage on their property that will truly pay to replace the buildings.

Get the coverage you need and the protection you deserve.

GEORGIA FLOOD INSURANCE VIDEO

FREQUENTLY ASKED QUESTIONS

All policies we offer have what is called the private flood insurance clause. This is the clause banks require in order for a policy to be accepted.

Most companies require flood insurance to be paid in full, but some offer quarterly billing. Premium financing is also available on some private flood insurance policies.

Generally, home insurance does not cover flood damage.

NFIP also known as the National Flood Insurance Program is the federal flood insurance program. It offers Building coverages of $250,000 and $100,000 for contents on residential policies. On commercial buildings it offers building coverage up to $500,000 and business contents coverage up to $500,000.Private flood insurance is through private companies that are accepted by most banks. They can offer more coverage than NFIP at a much lower price in many situations.

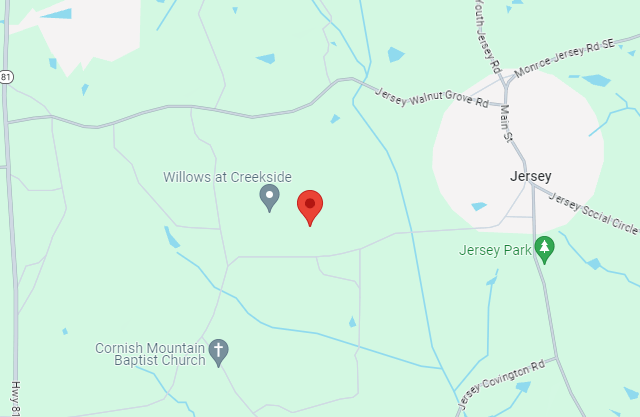

Flood Insurance Guru Location

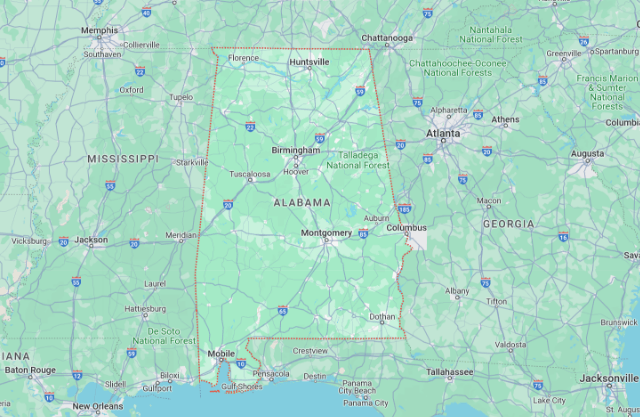

GEORGIA State Map

GEORGIA Flood Insurance: Secure Your Future

In Alabama, where weather can be as unpredictable as the tides, securing your property with the right flood insurance is crucial. At Flood Insurance Guru, we offer tailored solutions to safeguard your investments against flood risks. Our services cater to a diverse clientele, including property owners, real estate investors, agents, and loan officers. For property owners, we provide a range of government and private flood insurance plans, ensuring you choose the coverage that best suits your needs. Our team assists with policy changes, claims filing, and renewals, making the process seamless and stress-free.

Our services extend to real estate professionals as well. Real estate investors, agents, and loan officers can benefit from our expert guidance on managing risks, understanding coverage options, and accessing vital flood risk information. Our goal is to help you close deals efficiently and with confidence. We pride ourselves on our customer-centric approach, offering a learning center that is a reservoir of information, helping you stay informed about the nuances of flood insurance.

Start with a custom flood insurance quote from us. We guide you through every step, from understanding your flood risk to finalizing your policy, ensuring peace of mind regardless of the weather. At Flood Insurance Guru, we ensure that you never have to worry about your flood coverage again, providing comprehensive support and expertise in the field of flood insurance in Alabama.

Georgia Flood Insurance for Homeowners:

Homeowners in Alabama require specialized flood insurance due to the state's varied geographical and climatic conditions, which present unique flood risks. Our Alabama flood insurance for homeowners is designed to offer robust protection against these risks, whether you're near the Gulf Coast, along major river systems, or in urban flood plains. We understand the nuances of Alabama's weather patterns and topography, ensuring your policy covers the specific flood risks pertinent to your location. Our team provides personalized service, guiding you through coverage options, premium calculations, and understanding policy specifics. We emphasize educating homeowners on risk prevention and efficient claim processes. With our expertise, Alabama homeowners can enjoy peace of mind, knowing their homes are safeguarded against potential flood damages with comprehensive and tailored flood insurance coverage.

Real Estate Investors Flood Insurance Policy in Georgia:

In Alabama, real estate investors face unique challenges due to the state's diverse climate and geography, which can pose significant flood risks. Our flood insurance policies for real estate investors are designed to provide comprehensive protection for your investment properties across Alabama. We understand the importance of safeguarding your assets against flood-related damages. Our team offers personalized consultations to assess the specific needs of your properties, whether they're located in coastal areas prone to hurricanes or inland regions susceptible to flash floods. We guide you through the various coverage options, ensuring your investments are protected with policies that cater to the distinct flood risks in Alabama. Partner with us to secure your real estate investments with robust and reliable flood insurance coverage."

Flood Insurance Information for Georgia Real Estate Agents:

For real estate agents in Alabama, having accurate and up-to-date flood insurance information is crucial in guiding clients through property transactions. Our service provides Alabama real estate agents with comprehensive flood insurance information, tailored to the state's varied flood zones and risk profiles. We equip you with the knowledge to advise clients effectively, whether they're buying in high-risk coastal areas or in regions with lower flood probabilities. Our resources include detailed insights into policy options, coverage limits, and the impact of flood zones on insurance requirements. By collaborating with us, you can enhance your professional services, offering clients informed advice on flood insurance that adds value to their property decisions in Alabama's diverse real estate market.

Georgia Flood Insurance Coverage for Insurance Agents:

As an insurance agent in Alabama, offering clients the best flood insurance coverage is essential. Our services provide Alabama insurance agents with comprehensive knowledge and tools to navigate the complexities of flood insurance coverage. We offer detailed information on Alabama's specific flood risks, policy options, and regulatory requirements. Our goal is to empower you with the expertise to advise clients accurately, whether they're in flood-prone coastal regions or inland areas. We provide support in understanding various coverage aspects, from policy exclusions to claim processes. Partnering with us ensures you can confidently offer tailored flood insurance solutions, enhancing your portfolio and building trust with your clients in Alabama's dynamic insurance market.

Flood Insurance Policy Quote for Loan Officers in Georgia:

For loan officers in Alabama, providing clients with accurate flood insurance policy quotes is a key part of the property financing process. Our service specializes in delivering precise and timely flood insurance quotes, essential for loan approvals across Alabama. We understand the state's diverse flood risk areas and work closely with loan officers to ensure quotes meet both lender and borrower requirements. Our efficient process aids in expediting loan approvals, offering peace of mind to your clients. We provide detailed information on coverage options and premiums, tailored to properties in Alabama, whether they're in high-risk zones or areas with minimal flood risk. Our commitment to accuracy and speed makes us an invaluable resource for loan officers navigating Alabama's property financing landscape.

Flood Insurance Risk Advisory Service, Georgia:

In Alabama, our Flood Insurance Risk Advisory Service offers expert guidance and risk assessment for a range of clients, including homeowners, businesses, and real estate professionals. We specialize in analyzing Alabama's unique flood risks, which vary significantly across the state, from coastal areas to inland regions. Our service provides comprehensive evaluations, helping clients understand their specific flood risks and the best insurance options available. We stay abreast of the latest in flood mapping, environmental changes, and insurance regulations, ensuring our advice is current and relevant to Alabama's conditions. Our goal is to empower clients with the knowledge and tools to make informed decisions about their flood insurance needs, ensuring they are adequately protected against the diverse flood risks in Alabama.

-rgb-300px-w-300ppi.png?width=301&height=107&name=tfig-logo-inverted-(for-dark-backgrounds)-rgb-300px-w-300ppi.png)