Search for topics or resources

Enter your search below and hit enter or click the search icon.

January 5th, 2026

3 min read

By Chris Greene

You’ve probably been there, your FEMA flood insurance renewal shows up, and to avoid a lapse, you pay it. Then, a week later, you find out a private flood insurance policy could have saved you thousands.

So now you’re asking:

Can I cancel my FEMA policy mid-year and switch to private flood insurance?

The answer depends on the timing, not the price.

In this article, we’ll break down exactly when you can cancel, when you’re locked in, and why FEMA’s refund rules for 2026 are stricter than most homeowners realize. You’ll also learn about the misunderstood Reason Code 26, see two real-world examples, and get a step-by-step game plan to avoid being stuck with overlapping policies.

Many homeowners assume flood insurance works like their regular homeowners insurance. If you switch your homeowners policy mid-term, you usually get a prorated refund.

Flood insurance is different.

The National Flood Insurance Program (NFIP) only allows mid-term cancellations for specific qualifying events, such as:

You sell the property

Your mortgage is paid off

FEMA remapped your home into a zone where flood insurance is no longer required (like Zone X)

Finding a cheaper private policy is not considered a valid reason for cancellation.

FEMA offers a cancellation reason known as Reason Code 26, which applies when you have duplicate flood insurance policies.

This is where many homeowners get misled.

You might assume: “I’ll buy a private policy, send it to FEMA, and get a refund.”

But FEMA is strict about timing. For a Reason Code 26 cancellation to be accepted, your private flood insurance must be effective on or before your FEMA renewal date.

If it starts even one day after, FEMA will deny the refund.

Scenario A

FEMA policy renews January 1

Private policy starts January 1

✅ Refund approved

Scenario B

FEMA policy renews January 1

Private policy starts February 1

❌ Refund denied, and you’re double-covered

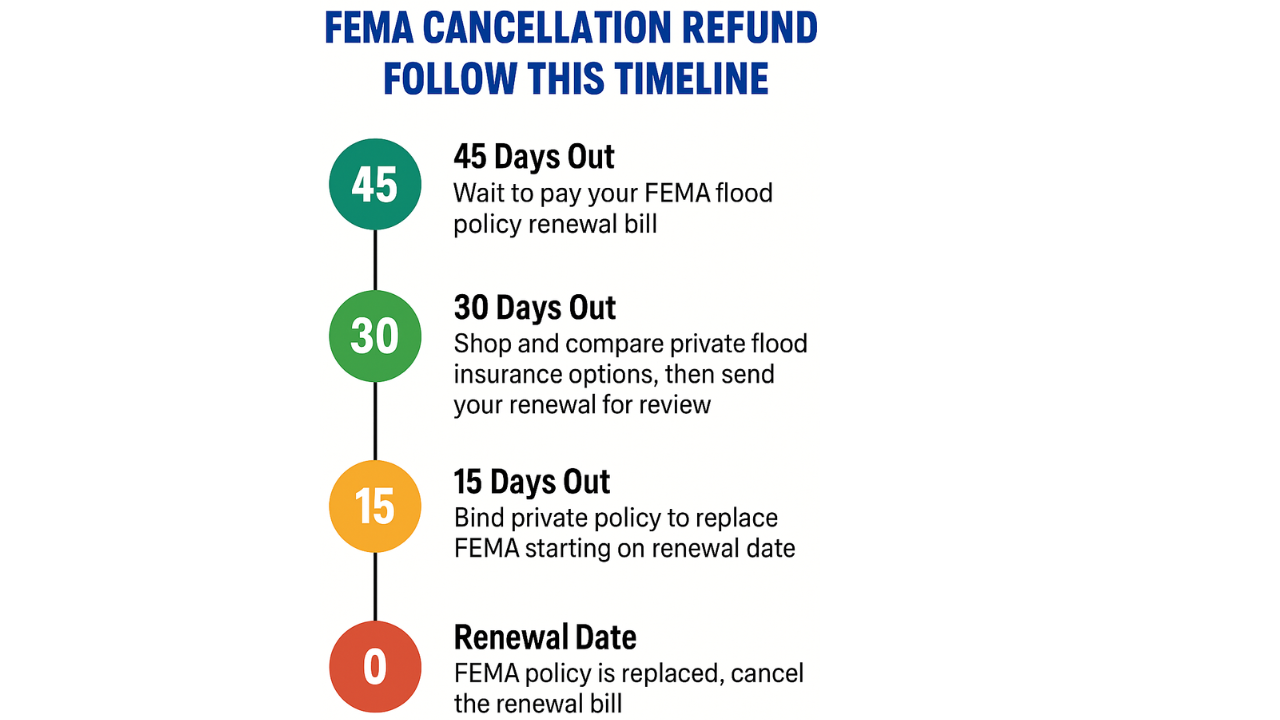

To avoid paying double, the 45-day window before your FEMA renewal is critical.

If you pay FEMA too early or delay shopping, you risk losing out on your refund eligibility.

Most private flood insurers follow FEMA's refund policies, including something called a minimum earned premium, meaning you must pay for a portion of the policy even if you cancel.

However, some private carriers offer more flexibility. For example:

Dual

AonEdge

These companies don’t enforce a minimum earned premium, so if you cancel mid-term, you may receive a partial refund.

Important:

Even with these flexible carriers, if you miss the FEMA renewal deadline, you still won’t qualify for a FEMA refund. Their flexibility only applies to their own policy, not to getting out of a FEMA policy that has already been renewed. These options are best used proactively, not as last-minute fixes.

Can I cancel my FEMA flood insurance after I’ve already paid for it?

Usually not. Once the policy renews, FEMA locks you in for 12 months. You cannot cancel just because you found a better deal afterward.

What is FEMA Reason Code 26?

It’s FEMA’s duplicate coverage rule. To qualify for a refund, your private policy must start on or before the FEMA renewal date.

What happens if I switch to private flood insurance after my FEMA renewal?

You’ll be double-covered, and FEMA will likely deny your refund request.

Are there private flood insurers that let me cancel mid-term?

Yes. Carriers like Dual and SonEdge may offer mid-term cancellation without penalty. But they cannot help you cancel a FEMA policy once it’s renewed.

How can I avoid getting stuck with two flood insurance policies?

Start shopping at least 30 to 45 days before your FEMA policy renews. Bind your new private policy to begin on the renewal date, not after.

The most common mistake we see is homeowners paying the FEMA renewal out of habit, only to realize too late that a private policy could have saved them 30 to 50 percent.

If your FEMA renewal is coming up, don’t pay it just yet. Send us your renewal notice, and we’ll compare it with private options from top carriers. We’ll time the switch perfectly so you avoid overlap, maximize your refund potential, and get the right coverage for your home and budget.