The Ultimate Guide to Flood Insurance for High-Value Homes in Flood Zone AE

Are you paying high premiums just because you’re in Zone AE? Will FEMA really cover your full home if disaster strikes? In this guide, we’ll reveal what FEMA doesn’t disclose, how private flood insurance stacks up, and how you can protect your high-value home without overspending. Whether your home is worth $750K or $3M+, we break it down simply—no jargon, no pressure.

Understanding Flood Zone AE and Your Risk

Flood Zone AE is a FEMA-designated high-risk flood zone. Contrary to popular belief, it’s not always coastal. Many AE zones are inland but still subject to significant flooding. If you carry a mortgage, flood insurance is mandatory here.

Common Misunderstandings:

-

AE isn’t always coastal.

-

Distance from water doesn’t mean low risk.

-

Homeowners insurance doesn’t cover floods.

What FEMA Policies Actually Cover

FEMA's maximum structure coverage is $250,000. Contents are capped at $100,000. It doesn’t cover alternative housing, valuable items like fine art, or rebuilding time. Luxury homeowners are often underinsured under FEMA.

Private Flood Insurance Alternatives

Private flood insurers can provide up to $5M in structure coverage and over $1M for contents. They often include loss-of-use and rebuild expenses FEMA doesn’t. They also base premiums on property-specific risk, which may result in lower rates.

|

Feature |

FEMA |

Private Flood |

|

Structure Coverage |

Up to $250K |

Up to $5M |

|

Contents Coverage |

Up to $100K |

Up to $1M |

|

Loss of Use Included? |

No |

Yes |

|

Policy Speed |

Slower |

Quicker quotes |

|

Premiums Based On |

Zone + property |

Real risk score |

Mortgage Requirements in Flood Zone AE

Lenders are federally required to ensure borrowers have flood coverage. Usually, this means meeting either FEMA’s minimums or the full mortgage amount. Many escrow accounts underfund premiums due to outdated risk models or recent FEMA increases.

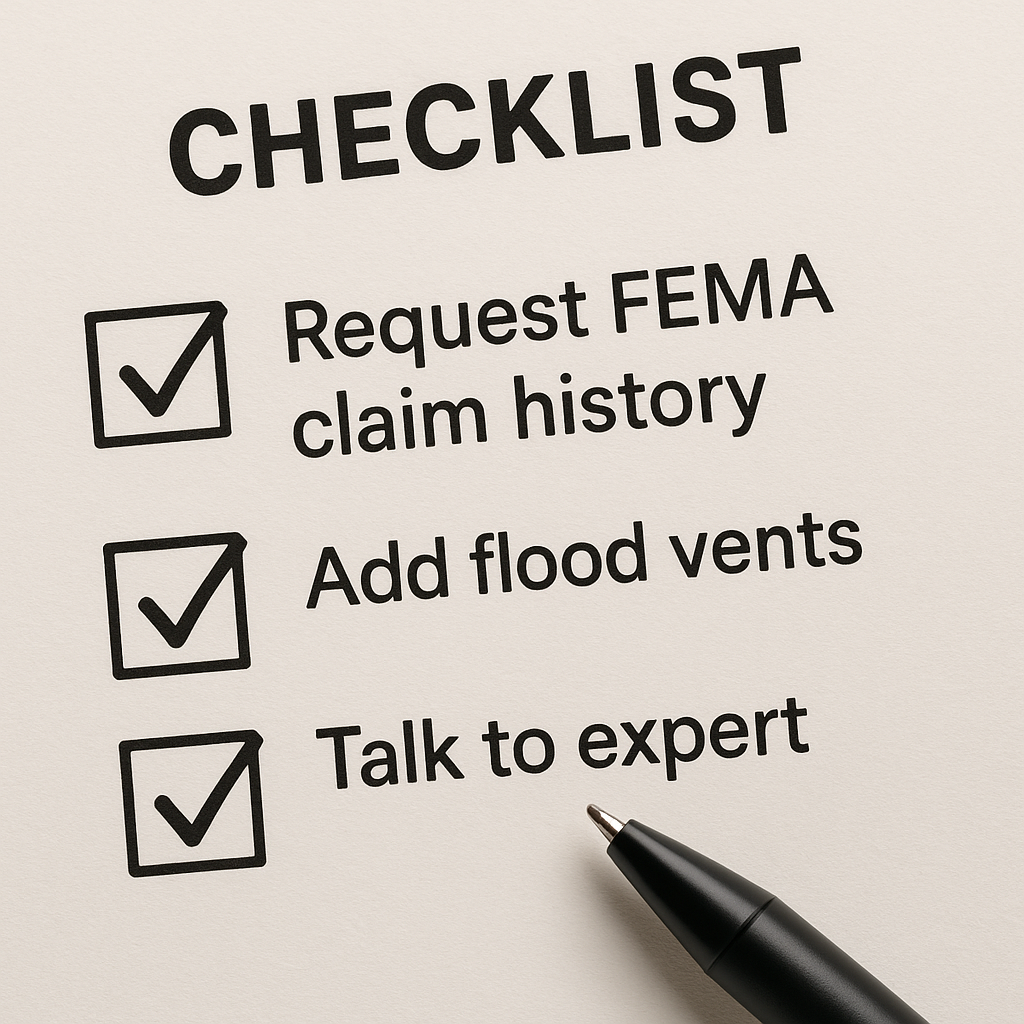

Coverage Strategies for Homes Over $750K

High-value homes often require layered coverage—FEMA or private as primary, then excess coverage above that. FEMA doesn't cover items like jewelry, collectibles, or antique furnishings. To reduce premiums, obtain an elevation certificate and install mitigation features like flood vents.

Top Questions + Glossary

We’ve gathered the most common questions from luxury homeowners in Zone AE:

-

Can I cancel FEMA if I go private?

-

What’s an elevation certificate, and do I need one?

-

Do I have to renew my policy every year?

4R Framework

Resolution

You now understand Zone AE, FEMA’s limitations, and private policy advantages.

Reminder

Most homeowners only realize they’re underinsured after the flood.

Relevant Next Step

Get Your Personalized Flood Insurance Quote

Reintroduction

The Flood Insurance Guru helps high-value homeowners avoid coverage gaps—let us protect your property.

Other Elements

- Download: Flood Zone AE E Book

- Use the Flood Insurance Calculator Tool

- Check out the Flood Zone AE Pillar Page

Flood Insurance Guru Blog's

Discover Better Flood Coverage with Private Flood Insurance

You don’t have to settle for expensive, limited flood coverage. Private flood insurance gives you better protection, more flexibility, and real peace of mind — at a price that makes sense. Ready to find out your options?

.webp?width=300&height=169&name=understanding%20flooz%20zones%20an%20essential%20guide%20for%20home%20owners%20(1).webp)

-1.jpg?width=300&height=169&name=maxresdefault%20(1)-1.jpg)