National Flood Insurance Program Risk Rating 2.0: One Year Later

October 5th, 2022

4 min read

By Chris Greene

Last year, September 1st, 2021, marked the beginning of the changes to how flood insurance works with the Federal Emergency Management Agency (FEMA). You might be one of the property owners who faced these changes head-on. This initially impacted the newly acquired policy on the aforementioned date.

In this article, we look at Risk Rating 2.0 and understand its overall impact on federal flood insurance, addressing flood risks, and how it impacted property owners throughout the United States.

Risk Rating 2.0: A Lookback

It's been years on end before the federal flood insurance was able to overhaul and update how they approach flood insurance. This came through the Risk Rating 2.0 program which aimed to address the risk of flooding across the United States.

This goal looks to provide a more accurate flood risk rating across the country. This also meant that your flood risk will be measured for multiple items. Here's how your policyholders are being rated based on Risk Rating 2.0. Here's how your rating methodology is changing:

- Zone designation in the flood insurance rate map (e.g. special flood hazard areas (SFHA); preferred flood zones)

- Distance to a body of water such as a river, lake, or even the coastline

- Prior flood insurance claims or flood claims made with the property

- Policy assumption and grandfather rule

The new things that will come with the Risk Rating 2.0 are as follows:

- Flood type that your property experience. This can be either pluvial or the accumulated water due to heavy rainfall, runoff of collected water that flows from higher areas, storm surge and coastal erosion, dam/levee damage or overflow, and even a combination of these things.

- First-floor height and elevation of the structure. A new feature that determines your flood risk score is the distance between the ground (grade) from your first floor or the first habitable floor of your property.

- Flood Risk Mitigation Measures made on the property. Is the lowest floor above the base flood elevation? Are there enough flood openings to let floodwaters through?

These changes were the goals of Risk Rating 2.0, but how did it really impact flood insurance a year after the implementation of this program?

Are Flood Risks Being Addressed?

After so much talk about the changes to federal flood insurance that FEMA will bring to homeowners and property owners across the United States, it's only common to ask if the risks are being addressed by these changes to flood insurance policies with the NFIP.

In order to answer this, we need to dive deep into its impacts. Let's start with the flood insurance premium rates with the National Flood Insurance Program (NFIP) after Risk Rating 2.0.

Flood Premiums

We've covered this in our multiple blogs about Risk Rating 2.0 and this might be one of the questions that you are asking yourself: how does Risk Rating 2.0 impact my premium rates?

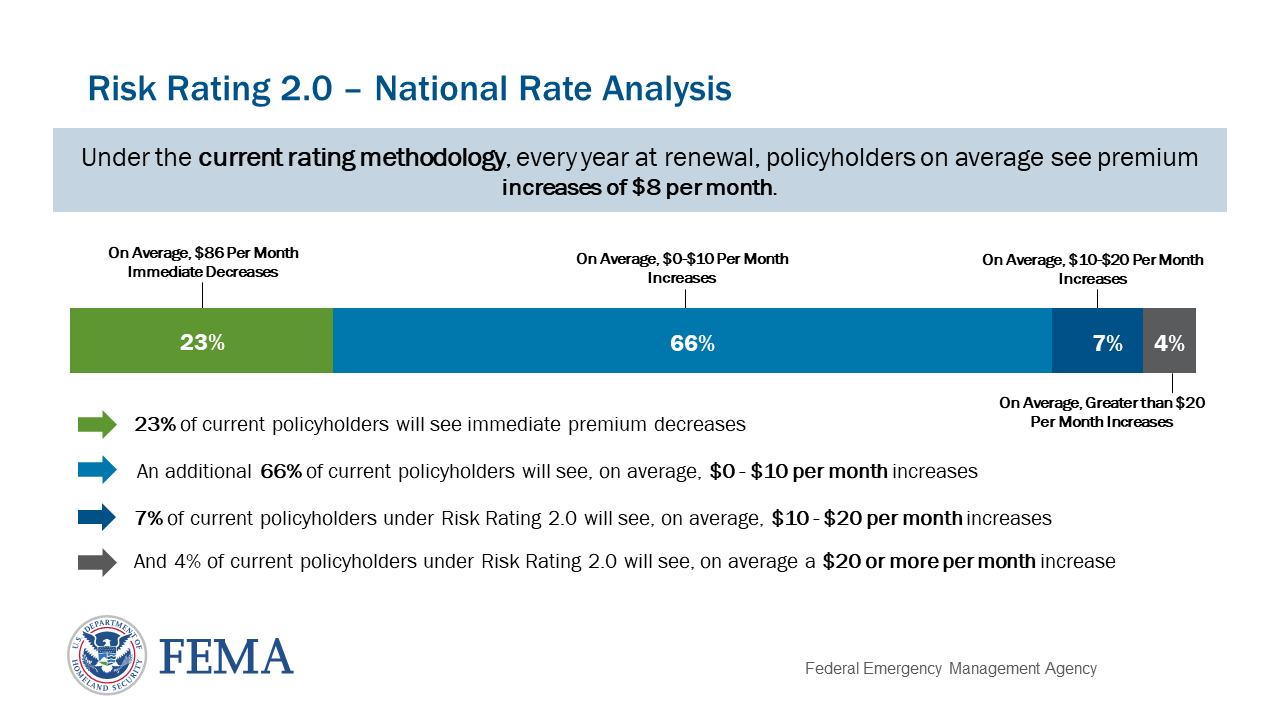

Generally, in FEMA's own report, about 77% of homes will be seeing some form of an increase in flood premiums with the Risk Rating 2.0. These premium increases vary from $1 up to more than $20 in monthly premiums.

To break it down for you, FEMA estimated even before the Risk Rating 2.0 program happened that at least 66 percent of homeowners will be seeing an increase of $0 to $10 per month or simply up to $100 annually with the policies.

This is because the Risk Rating 2.0 is showing more of the risks that each property is facing compared to simply just basing it on flood zones from flood insurance rate maps. Now, this part is important on how the changes to flood zone impacted flood insurance overall.

Flood Zone Requirements

One of the biggest things that came out with the Risk Rating 2.0 is how it addresses flood zones. In the Legacy Program — you might call it Pre-Risk Rating 2.0 or NFIP 1.0 — your flood zones generally tip the scales of whether or not your rate increases.

With the NFIP Risk Rating 2.0, these flood zones in your community's respective flood maps will only be used to see who's required to buy flood insurance. This means that if you're in a high-risk flood zone, like Flood Zone A also known as Special Flood Hazard Area (SFHA), you will definitely be required to carry flood insurance either by the state or your mortgage.

How did this impact risks for properties across the U.S.? A lot of insurance agents like us saw that people find that they have to adjust when selling individual properties due to the property value being impacted by these risks and the flood insurance requirement.

Number of Flood Policies

You might think that these changes are going to encourage more people to get flood insurance. We can't blame you, but considering the economical status of the United States with things getting more expensive, these increases on flood premiums might just be a thorn against buyers' and policyholders' side.

In August of this year, PreventionWeb reported that at least a 9% decrease happened to the total number of FEMA flood policies between the months of September 2021 and June 2022. This is around 4.96 million going down to 4.54 million across the country.

We also saw the same pattern where most of the residents of Mississippi don't have an active flood insurance policy. In this case alone, only 3% of Mississippi properties will have protection against flood damage in any potential flood event.

This is equally observable, especially in preferred risk areas wherein a 34% drop was noticed in the reports of E&E News. This means that policies decreased from 1.91 million on Sept. 30 to 1.26 million on June 30.

It's only fair to mention however that Risk Rating 2.0 also began to eliminate elevation certificates as a required document for buying flood insurance. Only time can tell whether or not this change with elevation certificates will positively impact the number of flood policies considering that getting an elevation certificate can really help lower flood insurance rates.

Are Flood Risks Being Addressed?

So, we go back to this question: does Risk Rating 2.0 really address the risks of both floods or is it creating a bigger risk with how it managed to approach flood policies across the country? In our take, Risk Rating 2.0 is a big uphill climb in addressing the actual needs of homeowners when it comes to flood insurance.

Just like anything, only time can tell where we'll go from here. Let us know your answer to this question.

Ready to solve your flood insurance problems? Here are the steps you can take:

- Fill out this form —

- Talk with our flood education specialist.

- Get back to the important things in your life.