As we further go into the Spring season, we slowly enter into the hurricane season as well. This year, the National Oceanic and Atmospheric Administration (NOAA) announced twenty-one names for upcoming hurricanes. Although this doesn't mean that we'll certainly get at least twenty-one hurricanes, it's still a good heads up for what might come this hurricane season. Today, we want to talk about the flood map changes coming to Dubuque in the state of Iowa and understand what it can mean for flood insurance.

We want to unpack the good, the bad, and the ugly changes of these flood insurance map (FIRM) changes. We also want to tell you how this can impact your rates and what your flood insurance options are.

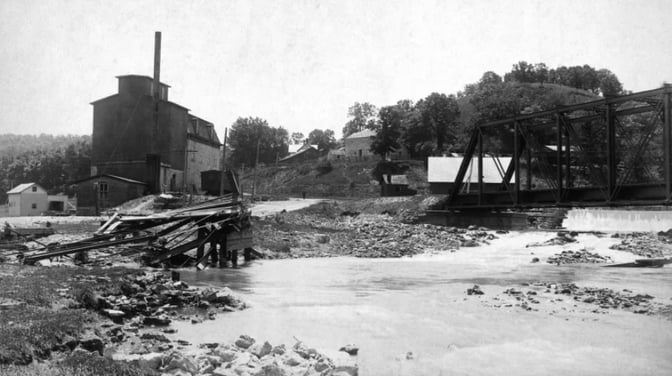

Flooding in Iowa

First, we want to cover the flooding that Iowa had experienced in recent years especially in Dubuque in order to understand how the Federal Emergency Management Agency (FEMA) — who analyzed, researched, and created these flood maps — arrived into the update they'll be putting into effect on May 10th (Monday).

In June 2008, Central Iowa was impacted by huge flooding that was considered worse for Iowa if you were to put it beside the Great Flood of 1993. This event totaled six billion dollars in damages and thankfully, no casualties. However, the amount of damages despite the flood mitigation efforts were felt throughout the state. Although Dubuque wasn't impacted compared to other parts of the state, the constant threat of flash floods was always there through the time of the flooding. The cause for this flooding was the warm and wet air clashing with what winter left on the state bringing rainfall and rivers rising.

Three years later, Iowa faced another flooding incident known as the Missouri River Flooding 2011. As expected, the winter leftovers were the culprit for the flooding as there were record snowfalls over Montana and Wyoming plus spring storms or rainfall causing rivers to rise and dams along the Missouri River to release record amounts of water to prevent overflowing. This caused levees across Iowa to collapse bringing flash floods to its local residents.

In retrospect, we've seen how much damages can constant rainfall in Spring can cause and how areas or states close to Iowa can impact flooding as well. This may happen again as we're seeing record levels of snowfall from winter on multiple states and relatively strong storms too.

Now, let's talk about the good, the bad, and the ugly changes that this new flood map update will bring to residents of Dubuque.

The Good

When it comes to what we call the good changes, this happens when your property is moved out of a high-risk flood zone or some would say "out of a flood zone". Although the latter statement is never true since you're always mapped into a flood zone, it just depends on how high the risks for flooding that you're property's facing is.

In the good flood map changes, this means that you're in an "in to out" movement which is something that around 1200 Dubuque residents will experience on May 10th. This means that previously, the property's mapped in a high-risk flood zone and is moving to preferred flood zones or low-risk flood zones. Some would call this moving to Flood Zone X.

This means that you will also get preferred flood insurance rates and flood insurance won't be required but is still highly recommended. It's important to note that even low-risk flood zones like Flood Zone X are still subject to flooding. In fact, most flood claims are coming from these zones according to FEMA. Now, when we say preferred rates, this means that you're getting the lowest possible premium rates for your flood insurance compared to those if you're moving into these low-risk zones. This can mean that your flood insurance rate will be around $1,000 or maybe lower than that.

The Bad

Now, when it comes to the bad changes, this is the exact opposite of the good changes. In the case of Dubuque, about 370 residents are moving into high-risk flood zone, like Flood Zone A, when previously they're in a low-risk flood zone. This movement is shown as the "out to in" in these flood map updates.

This means that these homeowners will now be required to carry flood insurance for their property since generally moving into high-risk flood zones prompts mortgage companies to impose mandatory flood insurance for the property. If you don't buy it yourself then your mortgage lender might force-place a policy for your house which is a really bad deal.

Flood insurance rates in these areas will also be higher. If Iowa's average flood insurance rate is about $1,045 then you can expect your premiums to be around this price and up to $3,000 depending on the construction of your house. If your property also has flood claims previously, this can also affect your rates and cause it to go significantly higher.

The Ugly

Now, let's talk about the worst part of these flood map changes which is what we usually call an ugly change. This is because of the movement that around 4200 properties will be going through this May 10th. The movement is shown as the "in to in" because these properties will be moving deeper into the high-risk flood zones or higher-risk flood zones.

The movement might be because you're in a Flood Zone A before the updates and then you're now going to be mapped into Flood Zone AE. This will bring a drastic increase in your flood insurance premiums. If we were to go back to the premiums we mentioned previously, this can go up to $5,000 to $8,000 in FEMA. This is the same for the bad changes since your mortgage will be requiring you to carry a policy, mandatory flood insurance, with your property. The federal flood insurance may also require you to produce and submit additional documents like photos and elevation certificates in order to write a policy for you, and this costs a lot of money as well.

Now, we want to cover your flood insurance options since we know that this is one of the most important things to prepare for the hurricane season.

Flood Insurance Options

The NFIP

First, let's go through the well-known option which is federal flood insurance. Also known as the National Flood Insurance Program (NFIP) is the government-backed option where you have to go through FEMA to get your policy here. It's important to note that there are certain red tapes you need to consider when going to federal flood insurance.

The NFIP offers maximum coverage for property damage of up to $250,000 and contents coverage or personal property coverage of $100,000 maximum. It's important to note that this number won't go up for residential properties. This can go up to $500,000 max only for commercial properties with the same coverage for contents. The NFIP won't be covering additional living expenses unless there's a presidential declaration, replacement costs, and loss of use.

It's also important to note that if you're looking to go through FEMA for your flood policy, there will be a strict 30-day waiting period before your policy can take effect. Depending on how fast you process the necessary requirements for flood insurance purchase, this may go up to 60 days especially if there are additional documents being asked.

One of the great things about the NFIP is if you're in a participating community, your Community Rating Score (CRS) can really benefit your flood insurance as this can provide you and your community in Dubuque a discount of up to 40%. Although this depends on your score, there's still a big chance of getting a discount through this program with FEMA. Being in a participating community also gives you access to disaster aid and disaster grants.

The Private Flood

Now, let's talk about the other option that most people might not know about or may shy away from, the private flood insurance market. It's important to note that there's nothing to be scared about the private flood as they do what your federal flood insurance can, if not more.

When it comes to private flood coverage, this doesn't have a coverage limit and maximum amount you can go up to. So, if you want to get more than $250,000 for your house and $100,000, you can do so with these private insurance companies. They also offer extra coverage like additional living expenses, loss of use, and replacement costs even if there's no presidential declaration for the flooding that happened.

It's important to note however that there might be some companies who won't write a policy due to the risks of flooding on your property. This may be due to the property's current flood zone designation or the history of flood loss and flood claims with the house. You won't have to worry about that however since you can still go through other private insurers since there's never one insurance company when it comes to private flood.

Since you're also buying from private insurers, they won't be held back by the red tapes that FEMA has to go through. This is why flood insurance policies from the private market can take effect as soon as you complete your requirements and payment on the flood policy purchase or up to fifteen days.

At the end of the day, being proactive and prepared beats being reactive when it comes to floodings. The choice of where you're getting your flood insurance doesn't really hold that much weight so long as you're making sure that there's a policy ready to save you from potential flood loss.

So, if you have questions on these flood map changes, the impacts it has on flood insurance for Dubuque, flood insurance options, or anything related to flood, reach out to us using the links below to call, get a quote, or visit and subscribe to our YouTube channel for our daily flood education videos.

Remember, we have an educational background in flood mitigation. We want to help you protect your property from flood risks and preserve its value long term.