Flood insurance options have always been a tug-of-war between federal flood insurance and private flood insurance. Historically, there are certain limitations to what flood insurance options you'll see and one of the key drivers of these options is your loan type.

Today, we see one of the biggest changes in the flood insurance industry in general: we will start to see some support for private insurers even for FHA-Insured Mortgages. So, in this blog, let's talk about these changes.

Loan Types & Flood Insurance

First, let's talk about why this is a big deal.

Historically speaking, if you have a Federal Housing Administration (FHA) loan with your home or property, you cannot get any private flood insurance policy. Instead, in compliance with FHA loan terms, your only flood insurance option is through the National Flood Insurance Program (NFIP) or through Federal Emergency Management Agency (FEMA).

This generally leaves a lot of homeowners facing some concerns about their coverage amounts since it's important to remember that the NFIP — even with their recent update of Risk Rating 2.0 — can only offer up to $250,000 for building coverage and $100,000 for contents or personal property coverage for residential properties.

Even if you want to get a private flood insurance policy, it's also very likely that your mortgage lender will not allow it.

The Private Flood Proposal

This new proposal from the Department of Housing and Urban Development (HUD) looks to eliminate this wall and allow FHA loan mortgages to also get a flood policy from private insurance companies. This means that flood insurance options for FHA-Insured Mortgages are now expanding to accommodate either a federal flood policy or a private policy.

Generally, the goal is that even for FHA loans, flood insurance options are in compliance with the Biggert-Waters Flood Insurance Reform Act and allow consumer choice while further encouraging participation from the private sector of flood insurance.

This proposal from HUD is expected to take effect on December 21st this year, but before you jump the shark and immediately switch from flood insurance, let's talk about some important things to keep in mind with this new rule for FHA-insured mortgages and USDA loans.

Things to Know

There are some conditions that you need to keep in mind before switching your NFIP policy to a private flood insurance policy.

- First, you can only switch to a private flood insurance company that meets the private flood insurance clause.

- Private flood insurance should also provide you with coverage that is no less than what a standard flood insurance policy offers with the NFIP. This means that they at least need to have that $250,000 and $100,000 for building and content coverage with their offer.

- Your mortgagee still has the power to implement or ask for more flood insurance coverage than required. This is so they can protect the mortgaged property.

- Lastly, you can't immediately cancel and switch to private flood insurance even if this new proposal is already effective. You will still need to wait for your renewal to cancel and switch to admitted private flood insurance. This basically means that if you miss that window of opportunity to cancel during your renewal of flood insurance, you will be stuck with the federal flood policy.

Basically, this means that your private flood insurance still needs to follow the overall expectations that FEMA and the NFIP have. So, you might be asking what are the impacts of this new proposal on the private flood insurance market.

Birmingham, Alabama

To answer this question, we will look at one of the states that's no stranger to flood risks: Alabama.

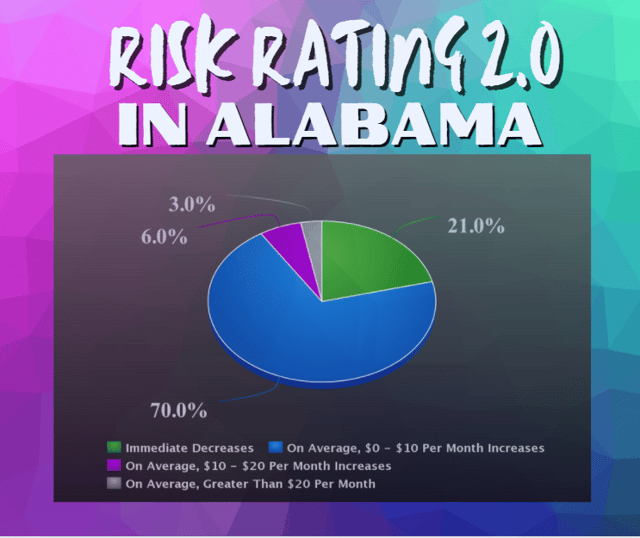

According to FEMA's estimation when Risk Rating 2.0 was implemented, about 79% of NFIP policyholders will see some form of increase of $0 and up to more than $100 in their premium rates. This generally hurt a lot of property owners especially when it comes to the real estate market.

It's important to note here that, generally, properties that sit on Special Flood Hazard Areas (SFHA) or sometimes known as high-risk flood zones tend to scare potential buyers. If your property is in the SFHA, this could also mean higher amounts of flood insurance rates, especially with the NFIP.

You also have no way out of flood insurance since being in the SFHA generally means that there's a mandatory purchase requirement for flood insurance. Availability of flood insurance through private insurers simply wasn't an option.

This proposal could change that as properties will have the ability to enjoy flood insurance benefits and private flood insurance coverage. Generally, this could also mean that properties that were finding some trouble in getting sold through real estate will now find more potential buyers as the worry of expensive premium rates and limited flood insurance coverage will be eliminated as well.

So, you might be wondering how this proposal can change and what's the big deal about flood insurance coverage with a private flood insurance company.

Coverages Through Private Flood

One of the key differences between a federal and private flood insurance policy is coverage.

Unlike flood policies from FEMA and the NFIP, private flood policies generally have more flexibility when it comes to your coverage. This could mean that you can definitely go above that $250,000 building coverage limit.

This can be a big help for property owners with more expensive properties. The same can be said for content coverage; you won't see coverage limits of $100,000 for personal property that you have within the insured building.

Additionally, some private flood insurance companies are also willing to provide excess flood insurance and some additional coverage such as additional living expenses. This coverage can easily provide coverage for the rent and other expenses you have as you wait for your property to be repaired.

Generally, you might be seeing more coverage and a quicker process for your flood insurance since most private flood companies only have up to 15 days for their wait period.

Flood Insurance Claims

Another big thing coming out of this proposal is that flood claims will basically find a reset. If you choose to go through the private flood, your claims history with this new insurer will be coming from a clean slate.

This means that you may not see a premium rate increase due to the previous claims filed on the property when you were still doing a flood policy with the National Flood Insurance Program (NFIP).

However, it's important to note that flood insurance claims are one of the main determiners of whether or not your property will fall into the repetitive loss (RL) or severe repetitive loss (SRL) list. This could mean that if your property is listed as SRL, you might not be able to switch to private flood as these properties are required to get flood insurance through NFIP Direct.

Accepting Private Flood

Overall, this new proposal from HUD can really help FHA-insured loans when it comes to your flood insurance options. Does this new proposal also mean that you can't go back to NFIP once you make that switch to private flood? No, you can still go through FEMA and the NFIP in case you changed your mind or find the federal flood insurance to fit your needs.

Since this proposal is very new, we still need to wait for an official word if switching to private flood insurance providers will be available for homeowners with FHA-insured mortgages and who are in a nonparticipating community.

It's also important to note that the HUD is looking to review this which is why they are open to hearing comments regarding the acceptance of private flood. So if you want to review this proposal, click you can refer to its official announcement by CLICKING HERE.

If you've got questions regarding this new proposal, whether can you switch to private flood, how to switch to private flood, or anything related to flood insurance, click below to access our flood learning center.

Ready to solve your flood insurance problems? Here are the steps you can take:

- Talk with our flood education specialist.

- Get back to the important things in your life.

Topics: