Kansas Flood Insurance: New Federal Flood Insurance Risk Rating 2.0

June 13th, 2021

3 min read

By Chris Greene

The Federal Emergency Management Agency (FEMA) is rolling out changes when it comes to flood insurance rates across all states in the country. Today, we will unpack these changes coming to Kansas and how they can impact your flood insurance in the future.

Today, we want to go over the changes coming to federal flood insurance for the Sunflower State of Kansas. We want to unpack the good, the bad, and the ugly changes that the National Flood Insurance Program's (NFIP) Risk Rating 2.0 and how it can impact your flood insurance in the future.

A lot of things will come into play on the rating structure for your flood insurance policy with FEMA. Flood insurance rates won't solely base on the property values in the market, so property owners should be aware of these changes. Things like the history of flood claims, where your lowest grade compared to the base flood elevation that the state or your community has, and risk of flooding (to name a few) are accounted for with this new rating methodology for the National Flood Insurance Program (NFIP).

The Risk Rating 2.0 will take effect on October 1st, 2021.

The NFIP 2.0

The Risk Rating 2.0, or commonly known as NFIP 2.0 as well, is more of equity in action. This update on the federal flood insurance program itself will allow you to no longer pay more than your fair share when it comes to flood insurance rate as this would now be based on the value of individual properties or homes starting this October.

When it comes to the rate changes happening across the country, you're going to see these colors in ranges which represent these changes with flood insurance rates from FEMA. Now, each of these colors represents the good, the bad, and the ugly changes coming to each state.

Truth be told, the actual flood risk nowadays lies in your protection against flooding or the lack thereof.

Let's unpack these and see what they mean for flood insurance.

The Good

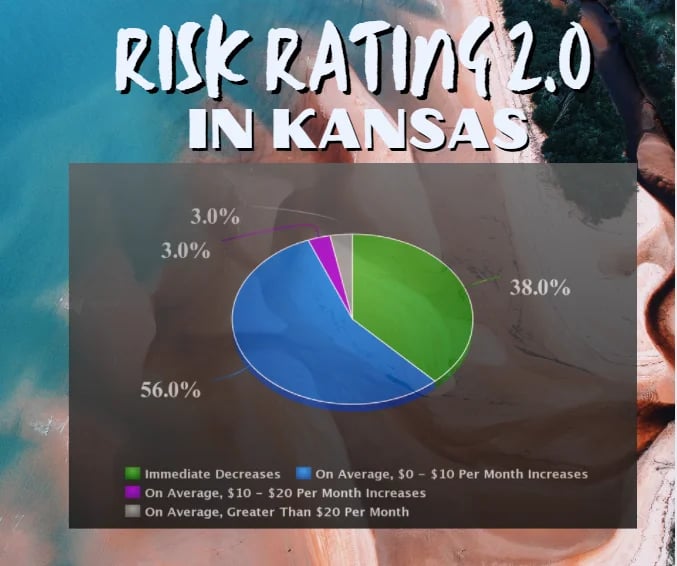

First, let's talk about the good change coming to the residents of Kansas. This is represented by that green slice or range. This will impact 38% or 3,694 policies in the state.

When it comes to flood insurance rates, the policyholders under this slice will get an immediate decrease of more than $100 (>$1200 per year). It's important for us to remember that the current average for federal flood insurance in Kansas averages about $980, this decrease can really help NFIP policies be another cheap flood insurance option.

This also somewhat helps people who can't get flood policies through the private flood insurance market. It's important to note that not all property owners in Kansas can get policies from private insurance companies or simply private insurers.

This market can decide when to and when not to provide their services for a property or even an entire community. We've seen this happen in Texas where private sectors of the insurance industry would be in moratoriums and/or non-renew policies after a flood claim just because the communities are becoming more flood prone.

The Bad

Now, when it comes to the blue slice which will impact most of Kansas policies. This slice is composed of 56% or 5,356 policies that will experience a bad change when it comes to flood insurance rates.

This is slice will bring an increase to rates ranging from $0 to $10 per month ($0 - $120 per year). The increase itself will bring up your premium to that $1000 mark easily once these changes kick in October 1st.

The Ugly

Lastly, we want to cover the last two slices you'll see with the NFIP 2.0 changes. It's important to put out a disclaimer that these two may have the smallest percentage, but they're the ones that pack a lot of punch when it comes to the changes to federal flood insurance. Let's break down the pink and grey slices.

The pink slice will impact 3% (296 policies) in the state and will bring an increase that ranges from $10 to $20 per month ($120 - $240 per month). Whereas another 3% (390 policies) goes to that grey range where the increase in flood insurance rates is uglier than the previous one.

This is due to the fact that the increase will be more than $20 per month (>$240 per year). This means that when it comes to that grey range, your increase can go up to more than $100 per month.

You can see a full graph of these changes below:

When Will It Happen?

Now, the date when you can adopt this program really depends if you're doing a renewal or if it's a new business policy. You see, you can expect these changes to start on October 1st and you're going to adapt to these rate changes if you're buying flood insurance from FEMA on or after that date.

On the other hand, if you're doing a renewal with FEMA after that date then you don't have to take in these new rate changes until April 1st, 2022.

So, you want to be very ready for this. We've been talking about this since last year since basically the NFIP is already 30 years old already and is in need of this change.

If you have questions on these upcoming changes, what are your flood insurance options in Kansas, or anything about flood, reach out to us through the links below. You can also watch this on our YouTube channel.

Remember, we have an educational background in flood mitigation and we want to help you understand flood risks through education and awareness in flood insurance and preparedness.