Topics:

March 22nd, 2022

2 min read

By Chris Greene

A lot of trades are going around in the National Football League (NFL) right now. One of the biggest names that are popping up is Deshaun Watson after signing a massive trade deal with the Browns.

This begs the question, is this the same flood insurance policy? Can you guarantee a flood policy despite having a property with a bad rep?

Watson Gets Traded to Cleveland Browns

Deshaun Watson gets a huge trade deal with his contract with the Cleveland Browns making sure to give him more guaranteed years and more total guaranteed money. This is a big turn of events due to the implications it has on the future of the NFL.

Watson is going to get a five-year contract and a total of $230 million over its course. This is particularly surprising not only because the quarterback has civil lawsuits against him, but because this is the only time we've seen this type of contract happen in the NFL.

Some would say that this is a quarterback with a bad rep in the field and outside of it but was able to guarantee one hell of a contract for himself.

Can we say the same when it comes to flood insurance?

Flood Policy Guaranteed?

Now, relating this to flood insurance policies which are basically your contract with an insurance carrier, it may sound that it's a different story.

You might be wondering if you can pull off what Watson did and guarantee a flood policy for your property despite its risks. This is especially the case when you start to look at the "bad rep" of the property you have or are looking to buy.

However, you can also Deshaun Watson your flood insurance purchase. How?

It's simple, you just got to make sure that you have the right coverages in place and to maximize the 80% rule.

What is the 80% Rule?

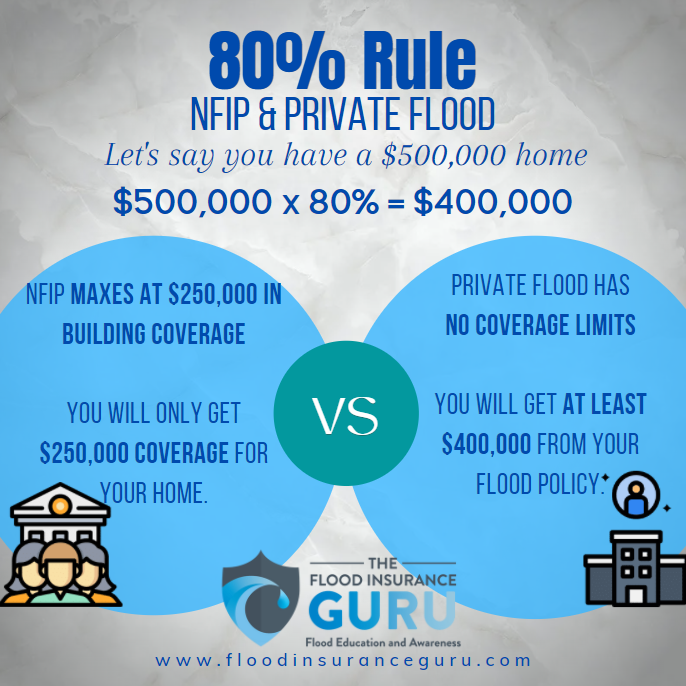

The 80% Rule, according to the Federal Emergency Management Agency (FEMA) and in the National Flood Insurance Program (NFIP), states that you must insure at least 80% of the value of your property or max out their $250,000 building coverage.

If you don't follow this 80% rule then your upcoming flood loss will only add to the bad rep that your property has. Why? That's because you won't be fully covered by FEMA and the NFIP if you don't follow this rule.

We've seen this happen on a $300,000 policy where the owner only insured 50% of it ($150,000). When the time to file a flood claim came, she only got $15,000 which is only 5% of the property's total value because nobody explained to her the 80% rule.

The same rule also applies to Private Flood Insurance too for some insurance carriers in the private market. Unlike federal flood insurance, they don't have a coverage limit of $250,000 on buildings, you can expect to get a higher amount especially if you have a property that's more than $350,000 in replacement cost.

Here's an example graphic to show how it's different between NFIP and Private Flood:

So when it comes to flood insurance, can you guarantee your flood policy the same way Watson did with the NFL?

YES — you can, especially if you follow that 80% Rule.

So, if you've got questions on guaranteeing your flood insurance policy and its coverage for your property. Click below to reach us!

If you've got other flood insurance questions, feel free to visit our Flood Learning Center where we try to answer all of your flood insurance questions with just a few clicks.

And remember, we have an educational background in flood mitigation which lets us help you understand your flood risks, flood insurance, coverages, and protecting the value of your property long-term.

Topics: