NFIP 2.0 vs Private Flood Insurance: The Ultimate Showdown

August 14th, 2021

6 min read

By Chris Greene

Today, as we move closer to the changes coming with the National Flood Insurance Program (NFIP) Risk Rating 2.0 update, we want to answer the question: "Will Risk Rating 2.0 eliminate private flood insurance?"

Ever since I've started working in the insurance industry, a lot of back and forth has been going between federal flood insurance and private flood insurance. A lot of communities have also been plagued by the question, where can I get the best flood insurance policies?

First, let's know the contenders for your flood insurance option. As you'd know, we have the federal flood insurance once again battling it out with the private flood insurance, but does this upgrade to the Federal Emergency Management Agency (FEMA) and the National Flood Insurance Program be enough to take the throne when it comes to flood insurance policies? Coming back stronger and better the second time. Is 2.0 a pretender or contender?

Tale of the Tape: NFIP Risk Rating 2.0

We've covered in our previous blog what the Risk Rating 2.0 is, but let's do a quick review.

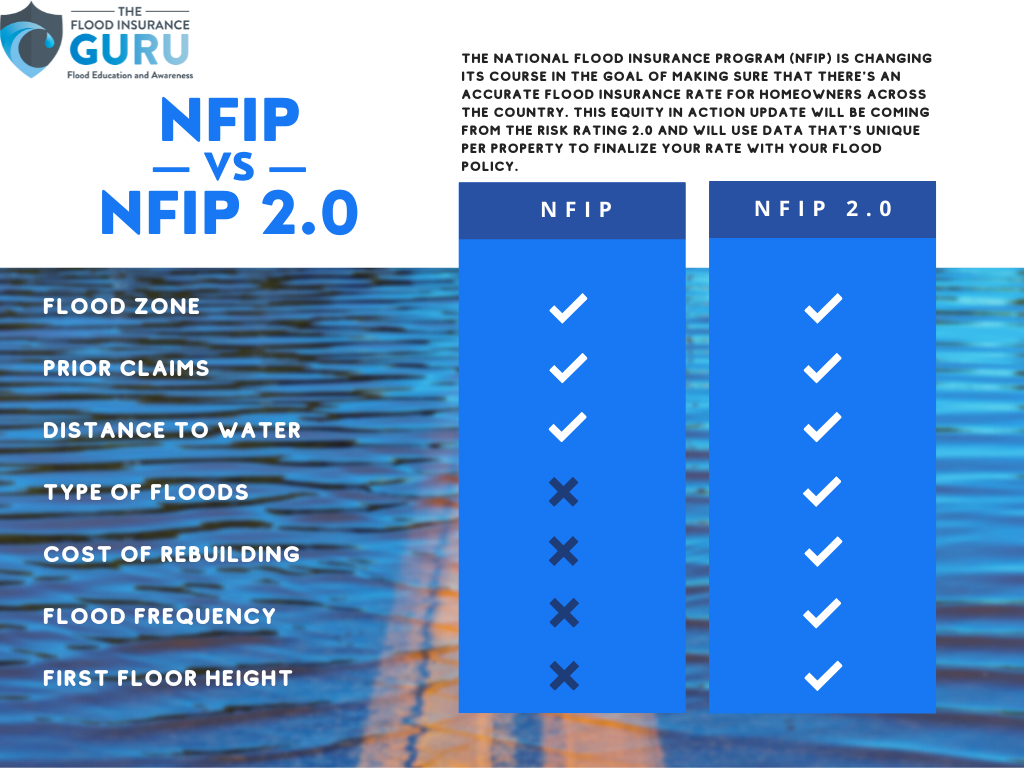

FEMA has been going about with a lot of flood studies preparing themselves for this new update. The Risk Rating 2.0 is one of this equipment in fighting flood damage for communities across the country. This new update is equity in action since the main goal of this update is to change how flood insurance premiums are being rated.

The federal flood insurance is gearing towards a fingerprint of flood risk for properties that get a policy from them since rates will be based on the individual flood risk. Although this makes it more affordable for flood insurance coming from FEMA, this may still bring an increase to rates for some property owners.

This type of change makes them a big contender to take the spot when you ask people where best to get flood insurance however it's integral to point out that other than how you're going to be rated, some things never change with the National Flood Insurance Program (NFIP) flood insurance.

When it comes to coverage, we're still talking about the same $250,000 maximum on dwelling or building coverage and $100,000 maximum when it comes to contents.

Other than these, these are all that the federal government can offer when it comes to flood insurance even with the Risk Rating 2.0 update. Here's a quick breakdown of the NFIP 2.0 card compared to the current version we have at the time of writing:

Tale of The Tape: Private Flood

Private flood insurance has made a big push in the last 15 years. There have been a lot of changes in the last 5 years that allow private flood insurance to be a great flood insurance option for many property owners. Let's look at exactly what private flood insurance is.

Private flood insurance is a flood insurance policy that is through a private flood insurance company instead of the National Flood Insurance Program (NFIP).

For many years the only option for many property owners was the National Flood Insurance Program (NFIP). There were many limitations with this program like wait periods, coverage amounts, and cost of the policy.

As a result, there has been a big push for private flood insurance because of the many advantages it offers. It's important to understand not all private flood insurance options are the same.

There are admitted and non-admitted carriers in the private market. Each one of these types of policies has different requirements they follow.

The private flood insurance market still offers flood coverage that doesn't really have any maximum amount. You can definitely still get more than $250,000. Even when it comes to personal items or contents coverage, you can definitely go more than $100,000 for flood damage. That coverage also comes with the loss of use, additional living expenses, and/or replacement costs.

Already, we're still seeing better numbers when it comes to the private flood market. When talking about flood insurance rates, there's also more flexibility to the punch of private flood insurers. The average premium in private flood insurance is also significantly lower compared to its counterpart with the NFIP.

We've also seen a lot of homeowners coming to us for flood insurance and were able to get it in just a few days. The maximum waiting period for a flood policy from a private insurance company is only 14 days.

The Rematch: NFIP 2.0 vs Private Flood

October 1, 2021 approaches NFIP Risk Rating 2.0 is scheduled to go into place. There are some big changes to this program like how rates are determined and the requirement for elevation certificates.

Traditionally if a property was considered a post-FIRM, or post-Flood Insurance Rate Map (FIRM) structure, and it was in a special flood hazard area (SFHA) more than likely an elevation certificate would be required just to get a quote through FEMA.

Pre-FIRM structures are structures that were built before the first flood insurance rate map in an area. Post-FIRM structures are structures that were built after the first flood insurance rate map in an area. Now there are some exceptions that could change the status of a property like additions and substantial improvements.

If you are like me and see private flood insurance advertisements every day one of the things they advertise is no elevation certificate is required. That's great you may not need one of these but it doesn't mean you are getting the best look at your flood risk or even the best flood premium.

The new NFIP Risk Rating 2.0 will cover property owners to use an elevation certificate or let FEMA look at other data to determine the rate. This could take away one of the advantages that private flood insurance advertises.

While private flood insurance may lose this advantage they still hold many others like

- Wait periods

- Coverages

- Flood Risk Scores

- Flood zones

Wait periods

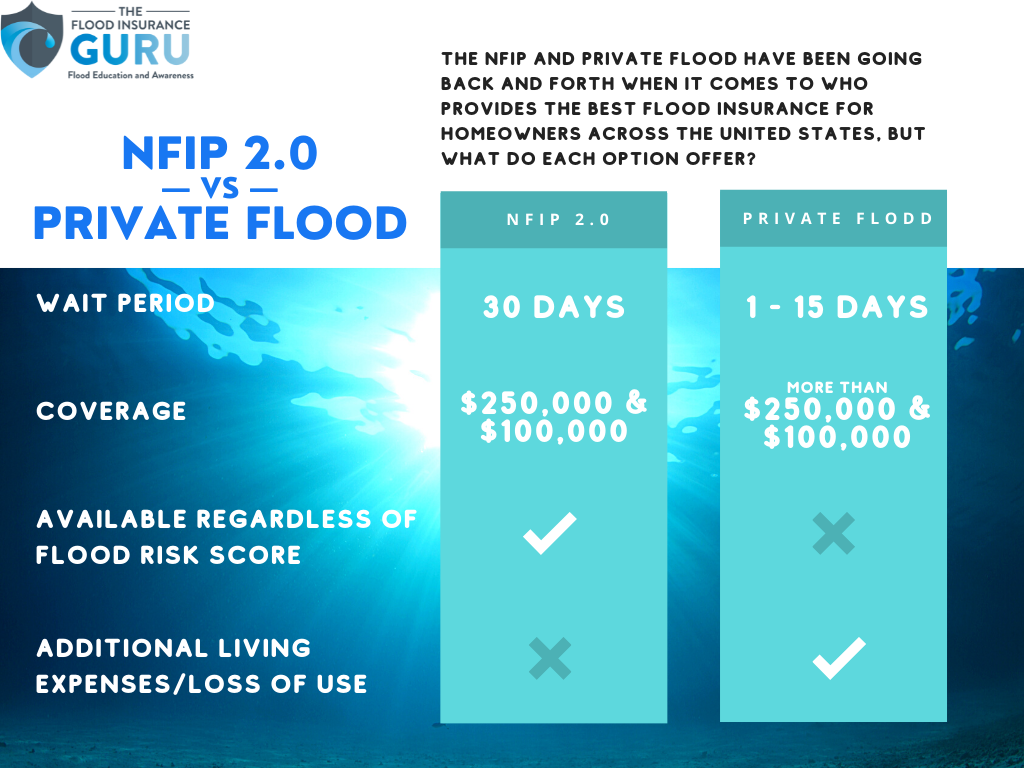

The waiting period is the time between when a policy goes into effect and when claims could be covered. The length of this waiting period varies depending on where you live, but it can be anywhere from one to thirty days. The longest wait period currently in the flood insurance market is the National Flood Insurance Program with its standard 30-day wait period. On private flood insurance many times it can range from 1 day to 15 days. It's important that both offer a no waiting period for loan closings.

Coverages

Coverages might be the area that separates the National Flood Insurance Program from private flood insurance the most.

The National Flood Insurance Program currently limits residential coverage to $250,000 on the building and $100,000 on contents with no loss of use coverage. Other than the Community Rating System (CRS) discount and some additional coverage for flood mitigation through the Increased Cost of Compliance (ICC).

Private flood insurance can go up into the millions for building coverage. When it comes to contents coverage the coverage can be much higher than $100,000. In fact, we recently helped a customer get over $1 million in contents coverage with a private flood insurance policy.

Loss of use is also a big coverage that is getting attention, especially on commercial flood insurance policies. This could help a business continue to get income that was lost as a result of a flood. This is something that the National Flood Insurance Program does not offer.

Flood Risk Scores

Flood risk scores is a scorecard private companies have been using to determine if they will take on a certain risk. The higher the score, the harder it may be to get private flood insurance. Many times these scores can increase after recent floods in certain areas. We saw this happen in the Midland Michigan area after a dam failure. We have also seen this happen in the Sacramento California area with their current dam and levee situation.

In years past, the National Flood Insurance Program (NFIP) has not really used this model. However, once NFIP Risk Rating 2.0 is released they will have their own model. It will include things like replacement cost of a building, distance to water, flood frequency, type of flooding, and claims frequency. These things could give people a more accurate flood insurance rate through the National Flood Insurance Program compared to years past.

Flood Zones

One area that has misled a lot of people is the relationship between flood zones and flood risk.

We hear people say every day "FEMA has me in a low-risk flood zone, so I don't need flood insurance". It's important to understand that in the future FEMA won't be using these zones to determine rates any longer. Instead, they will be taking more of the flood risk score model.

Private flood insurance companies have been using this for a while. In fact, we have seen when you change the flood zone with a private flood insurance company that the rate doesn't change at all.

So the great debate the National Flood Insurance Program versus private flood insurance. Which one is better?

This is a question we get on a daily basis. There can be advantages and disadvantages to both. The development of this new program could help make this even more debatable. We should start to see if FEMA has done enough to update this program when it releases on October 1, 2021, across the country.

So if you have questions about how to understand flood insurance or how to lower your flood risk then make sure to click below.

You can also check out our Youtube channel where we do daily flood education videos. Remember, we have an educational background in flood mitigation which lets us help you understand your flood insurance options, your flood risks, and mitigating your property long-term.

You can also check out our Youtube channel where we do daily flood education videos. Remember, we have an educational background in flood mitigation which lets us help you understand your flood insurance options, your flood risks, and mitigating your property long-term.